Safe, secure & confidential

May not be suitable in all circumstances. Fees may apply. Your credit rating may be affected.

The Debt Advice Service can guide you through all your options.

End stressful calls from creditors

End increasing interest and charges.

No debt collectors knocking on your door.

An IVA may reduce your monthly payments

| Situation | |

|---|---|

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

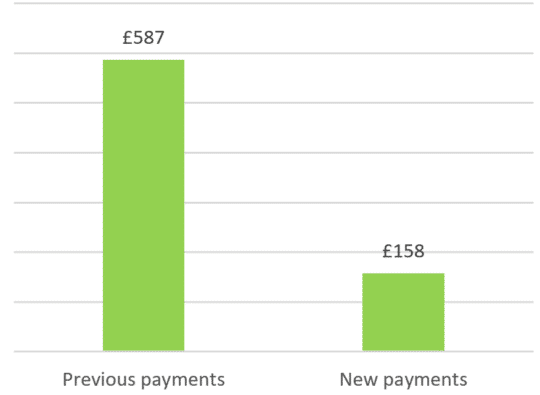

See how an IVA could help you turn multiple unsecured debts into one smaller monthly payment.

Your circumstances are you unique. The Debt Advice Service can help you choose what’s right for you.

Lower your monthly payments with your creditors to fit what you can actually afford.

Lower your monthly payments and potentially write off a portion of your debts.

Get your unaffordable debts written off with a fresh start.

Combine your monthly repayments into one, simpler payment.

More than 1,500 people have left The Debt Advice Service five-star reviews.

Amanda

Mandy

Georgie

To prevent utility disconnection, creating a repayment plan or exploring other debt management options could be beneficial. Check out this guide on lowering your debt payments.

In certain circumstances, yes. If repaying your debt seems unfeasible, there may be opportunities to eliminate some or all of it. However, seeking debt advice before deciding is crucial. Discover more about debt write-off options here.

While debt consolidation may seem appealing, especially if you have a poor credit history, it often involves high-interest rates. Thus, it might not be the most suitable choice. Learn more about some other ways to lower your debt here.

Despite feeling hopeless, various resources can provide assistance, including trust funds, credit unions, councils, energy companies, government programs, and charities. Check out my article on what to do if you’re worried about paying essential bills.

Establishing a budget is fundamental to financial management, helping to track expenses and ensure all bills are covered. This article on budgeting provides some insights to get started.

Understanding your rights when dealing with bailiffs is essential. It’s crucial to understand what they can and can’t do. Learn more about debt collection procedures here.

Inability to pay rent may lead to eviction, while failure to meet mortgage payments could result in home repossession. However, demonstrating a commitment to payment through a well-documented budget could mitigate these risks. Presenting your budget to your lender or landlord and adhering to the agreed-upon payment plan is key.